Balancing Financial Returns and Impact in Private Equity Investments

This article was originally presented at The Christian Economic Forum 2018.

Check out CEF for other quality content!

The Christian Economic Forum hosts a world-class Global Event each year to connect the top industry leaders and experts from around the world with other individuals who are compelled to act upon the principles of God’s economy. The following paper was presented at CEF 2018.

— by Johan Du Preez

Investments reward shareholders by increasing value (increased share price) and/or generating income (dividends). In short, we can refer to these as the economic benefits of ownership/financial returns from investments. A shareholder may be primarily interested in one or the other (value or income), or may want a healthy balance.

Increasingly, however, shareholders are also interested in the impact of the investment on the environment in which it operates. This we can label as the responsibility of ownership/impact of the investments.

When we view private equity investments from a Christian and therefore eternal perspective, we are challenged to view both the financial returns and the impact of ownership from the perspective of a steward representing the owner, rather than from a perspective of being the owner.

For the purpose of this paper, I assume that the economic benefits of ownership (financial returns) will increase the funding that is available for God’s work, and that the responsibility of ownership (impact) is evaluated from a biblical perspective. As such, it focusses on capital deployment “on behalf of God,” and the paper attempts to provide a very practical framework to facilitate discussion and decision-making in this regard.

Investment Strategies

Even though the above context should be easy for Christian private equity investment managers to understand and agree upon, the strategy to achieve this is bound to give rise to different opinions. In the end, there are many good and complementary (albeit distinctly different) strategies through which to ensure the biblical deployment of capital.

Absolute clarity about the strategy is important for commercial success (to avoid chasing after a thousand different things), for spiritual peace of mind (to avoid being guided by guilt and/or fear), and for personal well-being (understanding your role/calling in the investment space).

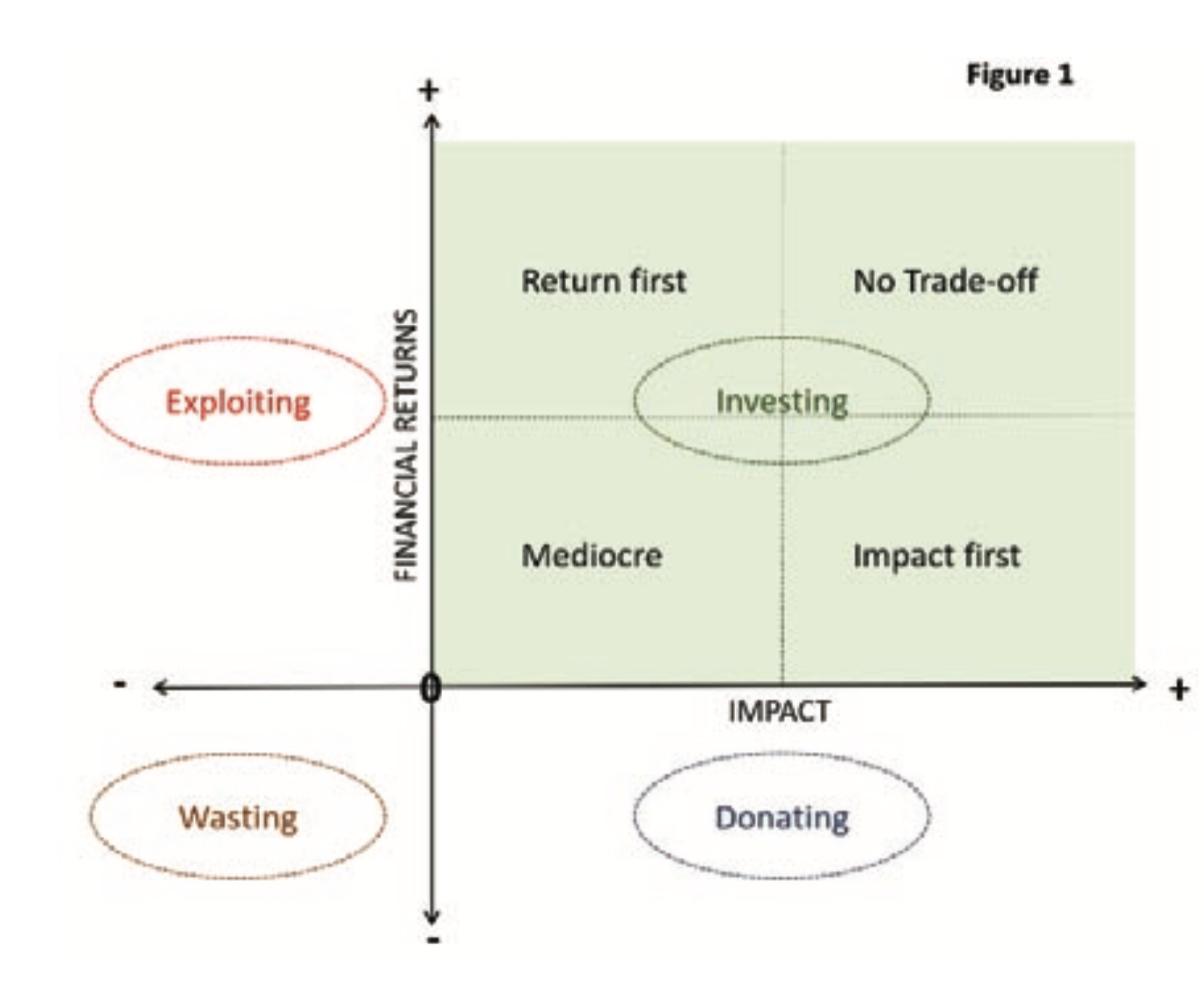

The potential trade-off between financial returns (economic benefits of ownership) and impact (responsibility of ownership) is illustrated in Figure 1.

Financial returns (vertical axis) and impact (horizontal axis) can be either positive or negative.

Negative financial returns represent donations – giving in excess of investment returns (it can also represent investments that unintentionally yield negative returns but I ignore that for purposes of this paper).

Negative impact equates to exploitation of people or planet.

The green area indicates investments that achieve the combination of positive financial returns and positive impact; this is the focus of the rest of this paper.

Four quadrants are identified and named:

Mediocre – below benchmark on both financial returns and impact

Returns first – favouring returns over impact (and achieving above benchmark returns)

Impact first – favouring impact over returns (and achieving above benchmark impact)

No Trade off – the ultimate achievement (high financial return and high impact)

Hurdles and Frontiers

Expanding on Figure 1, we can set Hurdles and identify some Frontiers (see Figure 2). Frontiers are considered objective (and fixed), whilst Hurdles are subjective (and variable).

The Financial return hurdle is the minimum Financial return the investment needs to achieve, regardless of measurable positive Impact.

The Impact hurdle is the minimum measurable Impact the investment needs to achieve, regardless of Financial returns.

The vertical axis is described as the Moral Frontier, i.e. we should operate to the right of it (avoiding negative impact at all cost). In practice this typically means having a negative list of things that will automatically disqualify an investment (such as sin industries, harmful environmental impact, exploitation of people, etc.)

The horizontal axis is described as the Sustainability Frontier, i.e. we should operate above it (ensuring it is sustainable by achieving at least financial break-even).

The orange line is described as the Stewardship Frontier, i.e. does the combination of Financial returns and Impact translate to good stewardship when viewed from a biblical investment perspective? (i.e. investments should be above and to the right of the orange line).

Post-investment Strategies

Clarity about the investment strategy (as briefly discussed above) is of utmost importance, but should also be complemented by stated objectives post investment. This is illustrated by Figure 3.

An investment strategy to target the “Impact first” quadrant can be complemented by a post-investment strategy to enhance the financial returns of the investment without necessarily compromising the Impact (see Red arrow). This can be done by introducing some commercial thinking into the impact-driven business model (“Head” intervention).

An investment strategy to target the “Return first” quadrant can be complemented by a post-investment strategy to enhance the Impact of the investment without necessarily compromising the Financial returns (see Green arrow). This can be done by introducing some impact considerations into the return-driven business model (“Heart” intervention).

The Tree of Life Foundation as a Practical Example

At the Tree of Life Foundation (TOL, a not-for- profit) we invest commercially to sustain ministries. Our end goal is to act as an “Investment Bank” for Christian Capital (providing a full spectrum of debt and equity solutions through an entity in which the shareholding is held by a non-profit), but as a first step we embarked on private equity investments in 2007.

Starting out we had to be clear about our initial focus, and we chose to adopt a “Return first” approach (driven by the experience of the key individuals, market opportunities, etc.). Due to our group structure (with the shareholding vesting in the Tree of Life Foundation), the profits from investment activities (and all the equity in the group) are available to fund Christian activities. Our task is therefore to decide what component of available capital should be re- invested as opposed to being distributed to Christian ministries. This is guided by our “dividend policy” that initially was set at “no dividend” and then gradually increased to the current policy, which states that 2.5% of Net Asset Value must be distributed to ministries annually (i.e., an “endowment mindset” allowing for sustainable giving with growth in real terms). The increase in dividend rate (distribution to charities) is an example of an increase in impact at group level (green arrow).

Getting back to the “Return first” strategy, it is very important for us to have a testimony in terms of biblical impact over and above the impact of giving away profits. In this regards we:

Defined a negative list of industries we will not invest in (sin industries) and practices we won’t tolerate (exploitation of people or planet, management with questionable ethics, etc.). The criteria is not what is legal, but what is morally acceptable from a biblical perspective (the higher hurdle).

Have a stated objective of introducing an impact component post investment.

The first bullet is self-explanatory, and easy enough to do. The way we handle the second bullet is to declare our intentions upfront (pre- investment) to the target investment company— we represent Christian capital and we therefore bring this worldview to the table when we join as a shareholder. This paves the way not only for robust discussions on ethical behavior, but also on remuneration, staff welfare, corporate giving, etc. We have been pleasantly surprised by the willingness of companies (in whom we invest) to embrace this, even in cases where such interventions caused a slight reduction in financial returns (i.e. where the green arrow points slightly downwards as it moves from left to right).

Summary

Financial returns and Impact represent two biblical parameters of investment decisions.

It is of paramount importance that the Christian investment manager is clear about both the focus of its investment strategy and the post-investment strategy for each investment.

In the context of this paper:

The investment strategy is the chosen quadrant in which the targeted investment should find itself (Return first, Impact first, No trade off).

The post-investment strategy is the targeted intervention that the investment manager seeks to facilitate and unlock post investment (Red/Green arrows).

The latter strategy will differ from one investment to the next, but it is highly recommended that it is defined upfront during the process of making the investment.