In my 20s, I faced a decision: accept a job at a large, multinational corporation or pursue vocational ministry. With a freshly minted degree from an international MBA program in the Arabic language track, I was certainly more strategically positioned for the corporate job.

Read More“Before we can even ask how things might go wrong, we must first explain how they could ever go right.”

These words from Friederich August Hayek, the Australian-born economist who won the Nobel Prize in Economic Sciences in 1974, set us on our path.

Read MoreThe purpose of the study was to better understand what widows experience and thus build a service model that engages, educates, and equips them to make wise financial decisions for their lives.

In October 2013, Ronald Blue & Co. asked selected widowed clients who are served out of their Atlanta office to participate in a small, intimate focus group.

Read MoreWe know intuitively that leadership and governance matter. Whether you are referring to a nation or a company, the manner in which people are led and governed greatly influences their creativity and productivity.

Read MoreIt’s not every day you get to have a conversation with someone who is widely considered to be a founding father, but that’s exactly where we found ourselves with Ron Blue. If you’ve been around the Faith Driven Investing conversation at all, you’ve no doubt heard the name, which is why we’re so excited he agreed to sit down with us.

Read MoreMoney is very emotional, and the markets are very emotional. And so a client will own a portfolio and see a portfolio sell off and not know what to do. It just has been a very important lesson for me to realize that it’s not just numbers on a spreadsheet – it’s someone’s dreams and it’s someone’s livelihood. I need to be respectful of that and a good steward of that.

Read MoreThe confrontation with the moneychangers has been used to enlist Jesus into an ideological war against finance. There are many examples, but probably the best known of them is FDR's inaugural address in which he extensively referenced this text.

Read MoreIn 2001 a 79-year-old man starting a financial services business asked me if I’d join him as an associate in starting a new business. I’ll never forget his response when I asked what in the world a 79-year-old was doing starting a business, “Mike, retirement is deadly. It’ll kill you!

Read MoreI’ll never forget one of the most haunting phone calls I received while a C12 Chair in 2013. Sitting at my desk in San Antonio I answered the phone for a call from Austin. The caller was a manager in an Austin-based company, whose former CEO was a C12 member.

Read MoreOne of the most anticipated IPO’s of 2019 hit enormous roadblocks and it serves as a powerful case study for us. In private fundraising rounds, Adam Nuemann, WeWork’s CEO, enjoyed incredible favor with investors. That favor finally ran out as skeptical Wall Street investors found flaws in the company’s governance, valuation, business model, and expense structure.

Read MoreWatch Martin Myers, Cofounder and CEO of Trelus, outline how to approach external growth capital options.

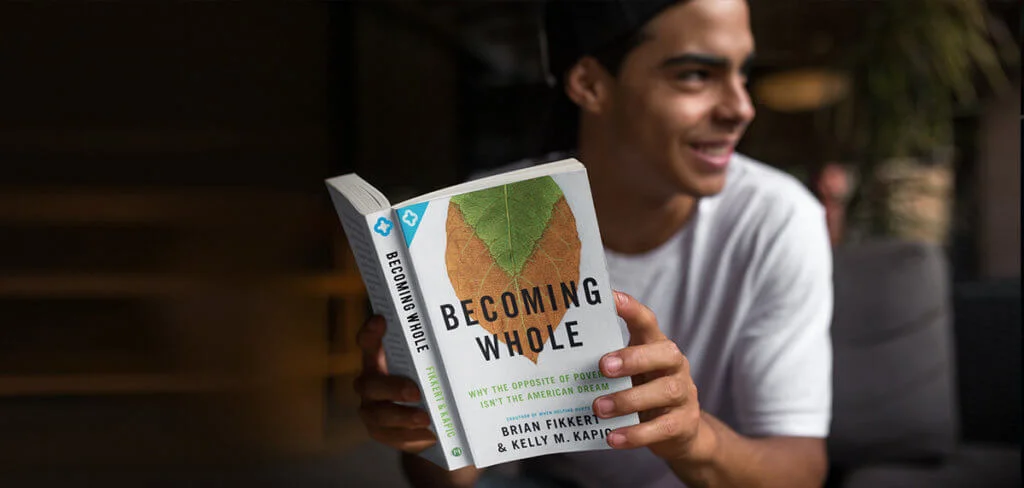

Read MoreWe are the richest people ever to walk the face of the earth, but according to research, we aren’t becoming happier. Families and communities are increasingly fragmented, loneliness is skyrocketing, and physical and mental health are on the decline. Our unprecedented wealth doesn’t seem to be doing us much good.

Read MoreFinancial advisors play a critical role in the future of America.

They are stewards of a sacred trust, helping clients to save money for when they can no longer work, live a life of generosity, invest in businesses that align with God’s purposes for the world, spend wisely, and re-discover their calling to work and serve their neighbors over a lifetime.

Read MoreWhen the Nasdaq closing bell rang last Thursday, investors in Beyond Meat were jubilant. Trading in the plant-based food company had driven up the share price 163 percent during its first day on the exchange.

Read MoreBrittany Underwood built Akola from nothing — each item of jewelry handmade in Uganda and distributed through their warehouse in the States where most jobs are held by women recently released from prison.

Read MoreThe day after selling our operating company we knew we were in the family office business and we knew we had a great deal to learn about the preservation aspects of wealth, but we then had to get real focused on the growth aspects of those assets.

Read MoreMuch attention is being given today to the behavioral study of investors. Irrational investment decisions have resulted in below market returns for many investors. This is coupled with neurological research revealing strong psychological impact from investment gains and losses.

Read MoreAt Access Ventures, they talk a lot about one-pocket investing and what it means for their organization.

And as they say themselves, we can’t do it all—no one can. Access Ventures partners with the Caprock Group as financial advocates for their values within the broader asset management system.

Read MoreThere are two commonly asked questions when the Christian Investment Forum introduces our mission of “Advancing the Awareness and Use of Biblically Responsible Investing“. They are “What is BRI?” and “Why should BRI be used?”.

Read MoreWhen we talk about investing, it’s easier to define what you don’t want to do. But it’s not just about avoiding the bad, right? Watch this video to learn about Business 360—a framework where you can look at how businesses engage with various stakeholder to make sure that you’re investing in ethical and positive organizations.

Read More